Sustainalytics Launches ESG Risk Ratings for Fixed Income and Private Equity

ESG ratings, data, and research provider Morningstar Sustainalytics announced today an expansion to its ESG Risk Ratings service to new asset classes including fixed income and private equity, as well as the addition of listed Chinese.

According to the company, the announcement marks a nearly 30% increase in coverage to more than 16,300 analyst-based ESG Risk Ratings.

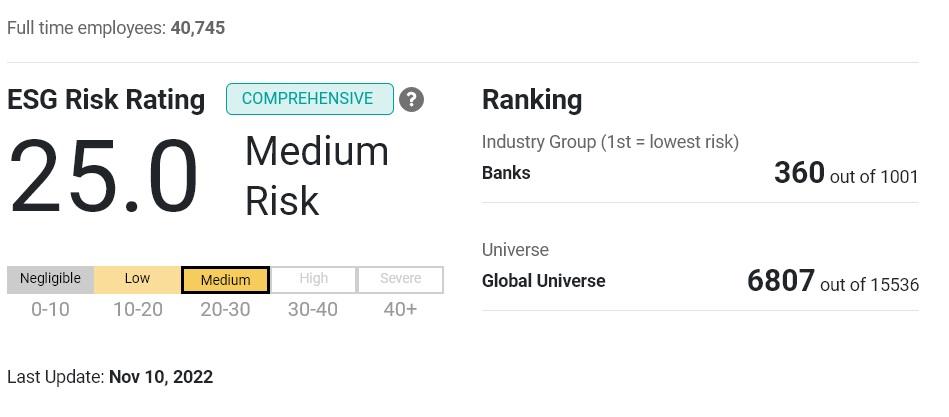

Sustainalytics’ ESG Risk Ratings are designed to measure a company’s exposure to industry-specific material ESG risks, and how well it is managing those risks. The provider’s research and ratings center on corporate governance, material ESG issues and idiosyncratic issues, and its ratings framework is supported by 20 material ESG issues that are underpinned by more than 300 indicators and 1,300 data points.

The company said that the new coverage is being added amidst increasing sustainable fund inflows in fixed income, stronger emerging markets ESG risk management and growing sustainability opportunities in private equity markets, while investors face challenges in availability of consistent ESG data in assets classes other than public equity.

Laura Lutton, Director of ESG Research and Risk products at Morningstar Sustainalytics, said:

“Sustainalytics’ recent coverage expansion provides investors more human insights supporting the consistent data and research needed to effectively measure financially material ESG risk. The ESG Risk Ratings harness the power of our global research analysts’ knowledge and capabilities when it comes to the nuances of ESG assessment.”