Sanofi Signs Two Sustainability-Linked Revolving Credit Facilities in First for Major Biopharmas

Sanofi announced today that it has signed two sustainability-linked revolving credit facilities integrating environmental and social features, marking a new sustainable finance first for a large biopharmaceutical company. The facilities include a new €4 billion revolving credit facility expiring December 2025, and an amendment of an existing €4 billion revolving credit facility expiring in December 2021.

Sustainability-linked securities have attributes including interest payments tied to an issuer’s achievement of specific sustainability targets, or Key Performance Indicators (KPIs). Sanofi’s revolving credit facilities (RCFs) incorporate an adjustment mechanism that links the cost of the facilities to the achievement of annual targets for two selected sustainable KPIs, namely contribution to Polio eradication and carbon footprint reduction. According to the terms of the RCFs, in the event that Sanofi achieves its yearly sustainability performance targets, the company’s lending banks will apply a discount margin to the securities.

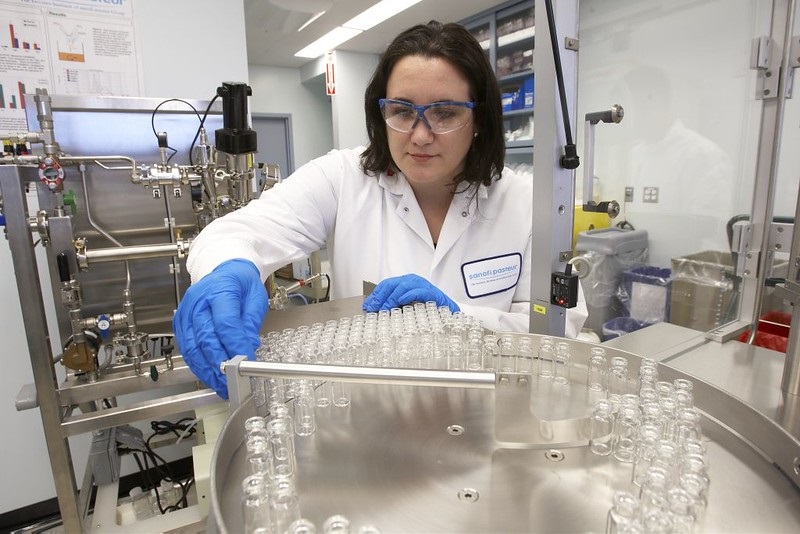

The selected KPIs relate to two of the company’s core sustainability commitments, including maintaining Sanofi’s key involvement in the final step eradicating polio, and its goal to achieve a 30% reduction of its carbon footprint (scope 1 & 2). The company’s emissions reduction goal has been validated by the Science Based Targets initiative (SBTi) as aligned with its most stringent category of a 1.5°C warming scenario.

Jean-Baptiste de Chatillon, Chief Financial Officer at Sanofi, said:

“We took the opportunity of the refinancing of our €8 billion lines to link our facilities to our sustainability performance. With this first sustainability-inked transaction, we are very proud to pioneer the sphere of Sustainable Finance for the pharmaceutical industry. Doing well and doing good at the same time is part of our DNA. We are convinced that this marks the first milestone of a long and promising journey to keep demonstrating the mobilization of all people at Sanofi towards sustainability.”

Sanofi stated that the innovative character of the transaction lies on Sanofi’s commitment to invest yearly a fixed contribution to both Sanofi’s Espoir Foundation and Sanofi Planet Mobilization program to fund social and environmentally responsible projects and maximize its impact on the two objectives. Sanofi Espoir works to reduce inequalities in health in France and internationally, with actions aimed at improving the health of the most vulnerable populations, particularly children. Sanofi Planet Mobilization is the company’s environmental sustainability program, which assesses and limits the direct and indirect impacts of its products throughout their life cycle on human health and the environment.

Laurent Lhopitallier, Head of Corporate Social Responsibility Coordination and Reporting at Sanofi, said:

“We are very pleased to begin our journey in Sustainable Finance with these two core facilities. Being the first supplier of IPV1 for GAVI2 countries, Sanofi has historically played a critical role from the very beginning in the fight for Polio eradication which is considered as a top priority by the World Health Organization. Far from being reached, the final step is now critical, and Sanofi has made significant commitments to make this “end game” possible. As climate change is intimately linked to health, Sanofi as a healthcare company has an important role to play, therefore we are committed to act to reduce our Greenhouse gas emissions along our value chain.”