Regenerative Farming Carbon Credit Startup Agreena Raises $50 Million

Regenerative farming-focused climate and fintech startup Agreena announced that it has raised €46 million (USD$50 million), in a Series B financing led by venture capital investor HV Capital.

Founded in 2017, Copenhagen-based Agreena provides a soil carbon certification platform, supporting farmers in the transition to regenerative agriculture practices through the issuance of third-party verified carbon certificates.

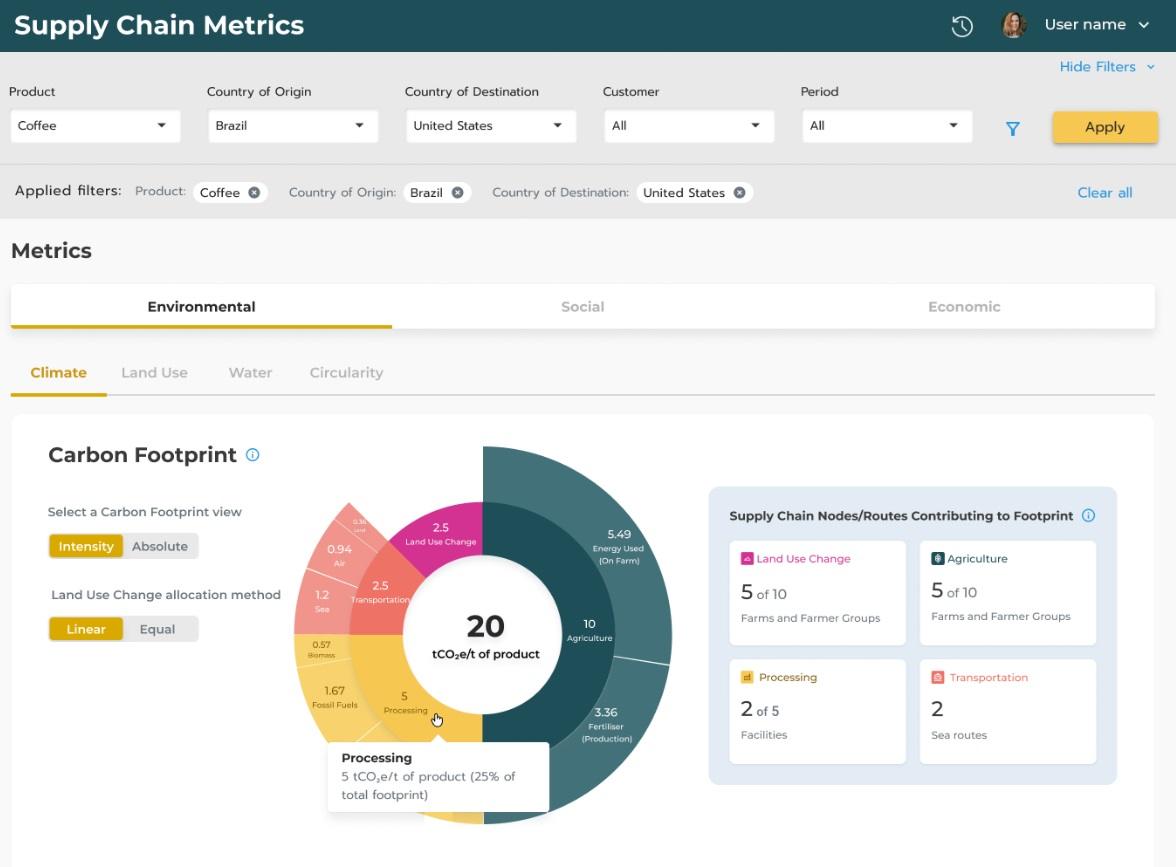

Regenerative agriculture practices are aimed at addressing the environmental impact of the sector, and include techniques to improve and restore ecosystems, build soil health and fertility, reduce emissions, enhance watershed management, increase biodiversity, and improve farmers’ livelihoods. Agreena’s platform enables farmers to plan, track and validate improvements through the implementation of regenerative practices, while the certificates also provide companies looking to offset their emissions with carbon credits from capturing and storing carbon in the soil, and offering companies in the food supply chain with field-level traceability of their agricultural commodities to meet Scope 3 reporting requirements.

Simon Haldrup, Co-founder and CEO of Agreena, said:

“In order for the world’s farmers to transition to regenerative agriculture and create a scalable climate impact, the financial rails to support and pay them for it need to be built. Agreena is building out technological and financial services infrastructure throughout the agriculture value chain as the industry increasingly becomes a focal point for decarbonisation efforts.”

The capital raise follows Agreena’s €20M Series A in 2022, with the company scaling its activities 10x since then, and expanding its geographic footprint to 16 European countries, helping to transition more than 600,000 hectares towards regenerative farming. The company also acquired remote sensing company Hummingbird Technologies last year, adding agridata services for supply chain players, governments and other institutions to its offerings.

Additional participation in the financing included new investors impact fund AENU and fintech-focused Anthemis, as well as existing investors Gullspång Re:food, Kinnevik and Denmark’s Export and Investment fund.

Alexander Joel-Carbonell, partner at HV Capital, said:

“Real climate impact is only created at scale and Agreena is perfectly positioned to distribute their carbon farming capabilities across the globe to bring high-quality, verifiable and nature-based carbon credits to the market. Only with carbon removals, can net zero targets be met.”