Refinitiv Adds Lipper Fund ESG Scores to Toolset

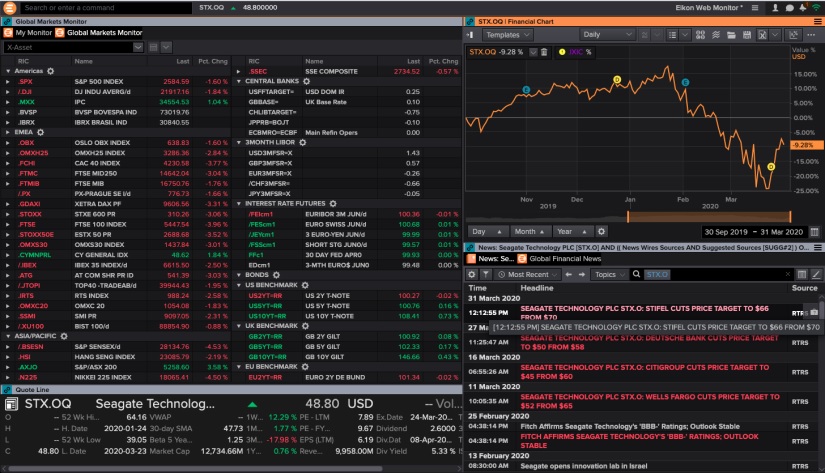

Refinitiv announced today that it is rolling out Lipper Fund ESG Scores, a fund-level measure of ESG performance providing data and analytics-based comparisons for fund managers, advisors and investors. The Fund ESG scores are available on Refinitiv Workspace, Eikon or API Feed.

Refinitiv stated that the new Fund ESG Scores bring together the Lipper fund universe of 330,000 fund share classes and its deep holdings content, ESG coverage on 9,000+ companies representing over 80% of global market capitalization, and Refinitiv’s proprietary scoring methodology which factors in issues such as materiality and transparency stimulation, to create fund scores on over 19,000 unique portfolios representing $15.7 trillion in total net assets across equity, bonds and mixed funds.

Today’s announcement marks another step in Refinitiv’s efforts to enhance its ESG information offerings. In March 2019, the company brought together its ESG Sustainable Investing and Lipper Fund Ratings businesses to increase focus on unearthing links between sustainable business strategies and financial performance. Earlier this year, Refinitiv announced enhancements to its ESG Scoring Methodology, by making ESG scores more data driven, accounting for industry-based materiality weighting of metrics, with minimal company size and transparency biases.

Refinitiv Lipper Fund ESG Scores utilizes publicly-reported data on constituents within a fund to transparently and objectively measure ESG performance, commitment and effectiveness across 10 main themes, including emissions, environmental product innovation, diversity and inclusion, human rights, and shareholders, among others.

David Craig, CEO of Refinitiv, said:

“Even as the world addresses the challenges of COVID-19, climate change remains one of the largest global issues impacting communities, food supplies, bio-diversity and economies. It has become imperative for financial markets to address so investors can direct funds to transitionary projects and away from high carbon and carbon-equivalent industries, and to meet an increasing number of regulatory mandates. Sustainable finance isn’t just a political or social choice — it’s a smart business decision. Refinitiv is proud to play its part in encouraging this transition by providing trusted data and analytics to investors, traders and advisors so they can evaluate ESG performance and allocate capital.

“ESG scores are a uniquely effective way to assess performance across industries, factoring in issues such as materiality and transparency stimulation, and serve as an objective and impartial assessment of the importance of each ESG theme to different industries.”

The company noted that while the level of assets under management self-identifying as ESG-focused appears to be ever increasing, the variety and style of ESG incorporation is highly inconsistent – ranging from negative screening to deep ESG integration. As ESG considerations become increasingly critical, the company believes its new fund scoring capability will provide investors with a differentiated asset that offers them a superior route in optimizing capital towards sustainable outcomes.

Refinitiv Lipper ESG Fund Scores incorporate two overall ESG scores in the model:

- ESG score – measures company’s or fund’s ESG performance based on verifiable reported data in the public domain.

- ESG combined score – overlays the ESG score with ESG controversies (impact of negative events) to provide a comprehensive evaluation on the company’s sustainability impact and conduct in near real time.

There are three total pillar scores to review how a fund or company performed according to the individual pillars of E, S and G, which are made up of 10 key themes. Refinitiv’s approach is to score the fund based on constituent attributes, in a bottom-up methodology, using Refinitiv company ESG data and scores and combining it with the deep holdings data on its global funds universe in Lipper.

Leon Saunders Calvert, Head of Sustainable Finance, Lipper & I&A Insights, Refinitiv, said:

“At Refinitiv we are focused on bringing transparency to markets and we believe we have unique assets across Lipper fund holdings, our extensive ESG company coverage and our proprietary scoring methodology. In addition to servicing the ESG expert community we believe we can help mainstream sustainability into the financial markets by delivering meaningful data, analytics and tools to finance professionals, allowing them to incorporate ESG factors more easily into the investment process. The launch of Fund ESG scores is an important step in this process.”