Novata Launches Benchmarks to Enable Private Markets Investors to Compare ESG Performance

Private markets ESG-focused technology platform Novata announced today the launch of a new collection of ESG benchmarks, aimed at enabling private markets investors to assess their ESG performance relative to peers.

Novata is a public benefit corporation founded in 2021 by a consortium including S&P Global, the Ford Foundation, asset management firm Hamilton Lane, and social change-focused investment firm Omidyar Network, and supported and advised by several leading private equity firms and pension funds, to provide private markets investors with a solution for ESG measurement, data collection and benchmarking, and enable reporting on ESG data.

Since launching, Novata’s platform has experienced strong demand, with more than 4,000 private companies already contracted to use the platform, and earlier this year, the company announced that it had raised $30 million in a Series B funding round, led by Hamilton Lane and adding Microsoft as an investor through its Climate Innovation Fund.

The benchmarks are based on more than 30,000 data points from companies across 23 countries.

Alex Friedman, CEO & Co-Founder at Novata, said:

“Collecting ESG data is the important first step – but once you have the data the question becomes: ‘How does this compare to others like me? We are pleased our benchmarks will empower Novata’s clients to review their ESG data in context, and enable companies to refine their ESG strategy, effectively manage risk, and increase accuracy in reporting.”

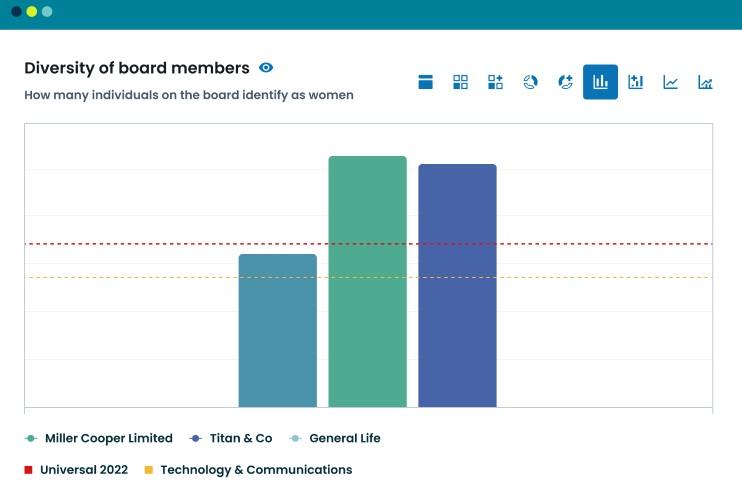

Novata introduced benchmarking tools to its platform in November 2022, enabling users to compare ESG data against industry averages and identify opportunities for improvement. With today’s release, the company significantly expands the platform’s benchmarking capabilities, to now include 50 universal benchmarks and more than 200 sector specific benchmarks for the 2022 reporting period.

Harry Mallinson, Head of Data Science at Novata, said:

“ESG data is nearly impossible to understand in a vacuum. The private markets, a historically opaque industry, have long needed a mechanism to compare and evaluate what ‘good’ ESG data looks like. We consider Novata benchmarks to be the critical infrastructure needed to get a full picture of your ESG performance, identify areas of improvement so you can effectively allocate resources, and, in time, increase financial value.”