MSCI Launches ESG Materiality Map, Providing Transparency into ESG Ratings

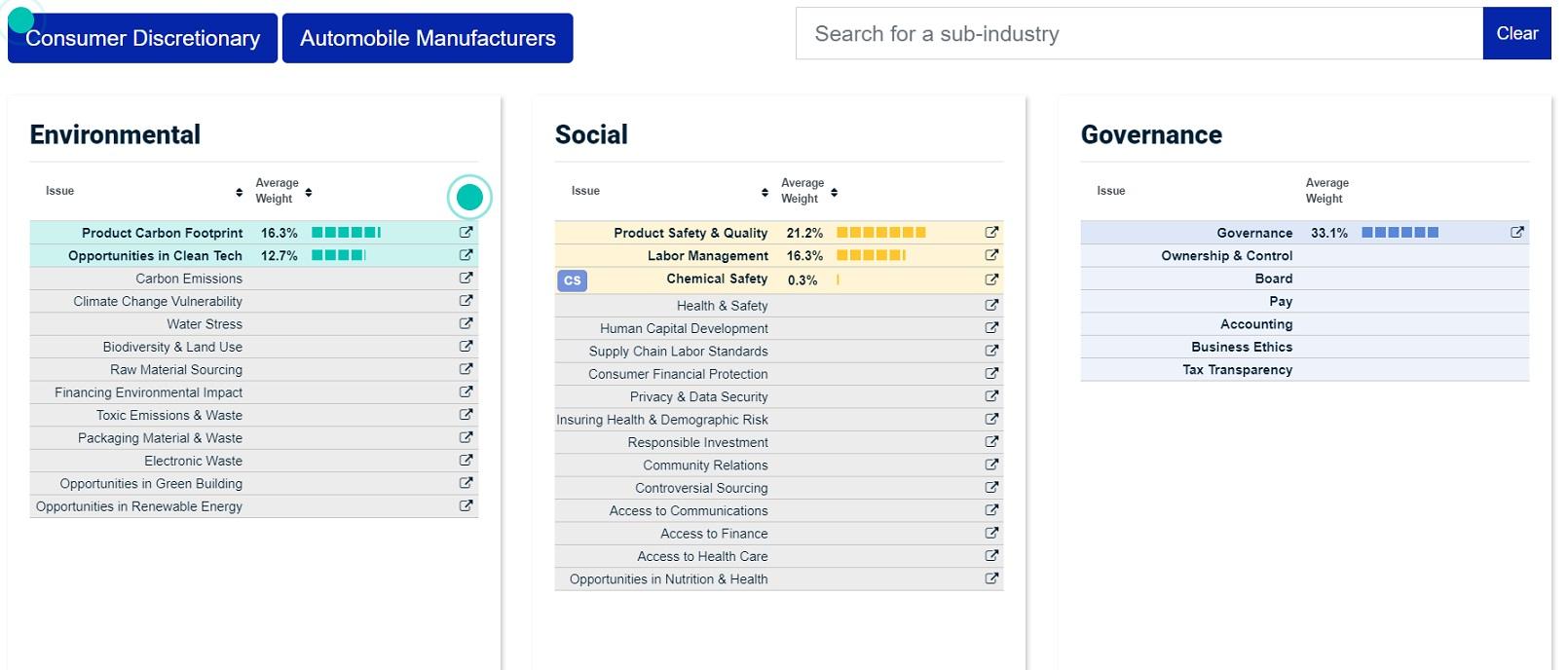

Investment decisions support tools and services company MSCI announced today the launch of the MSCI ESG Industry Materiality Map, a public tool aimed at providing transparency into the dynamic and industry-specific MSCI ESG Rating model, allowing users to delve into key Environmental, Social and Governance issues that impact different industries.

Materiality, or determining the importance of a piece of information, is a key issue in ESG investing, and can often be a key point of misunderstanding. Investors exploring the sustainability aspects of an investment or portfolio will come across many factors and that can impact their subjects’ ESG standing, yet determining the relative significance of each factor can be very difficult. Materiality assessments become even more challenging when considering investments across multiple industries, where different factors can have different weights. Similarly, the scores provided by ratings providers can seem opaque, if one does not understand the importance given to each factor.

MSCI’s new Materiality Map aims to address these issues. The company stated that the map explores the key E, S and G issues by GICS sub-industry or sector and their contribution to companies’ overall ESG Ratings. According to MSCI, the map is a continuation of the company’s mission to increase transparency and educate companies, investors and industry stakeholders of the value of ESG data and ratings.

MSCI also said that the Materiality Map showcases some recent ESG Ratings model enhancements, which include a heightened focus on corporate behaviours, such as fraud and anti-competitiveness practices, across all sectors, assigning greater weight to governance, alongside environmental and social considerations. The updates take into consideration input from some of the world’s largest institutional investors as part of MSCI ESG Research’s annual Ratings model consultations.

Linda-Eling Lee, Head of ESG Research at MSCI, said:

“MSCI is continuously investing to expand and improve our ESG and climate solutions to support the evolving and complex needs of the investment community. Our new public industry Materiality Map underlines our commitment to transparency and our strong belief that we have the most robust models in the market for capturing short and longer term ESG risks that help our clients build better portfolios.”