JPMorgan Builds Out Sustainable Growth Private Equity Team

J.P. Morgan Private Capital announced the appointment of Alex Bell as a Partner of its Sustainable Growth Equity (SGE) platform, in a move that will deepen the team’s climate solutions expertise and expand its reach in European markets, according to the firm.

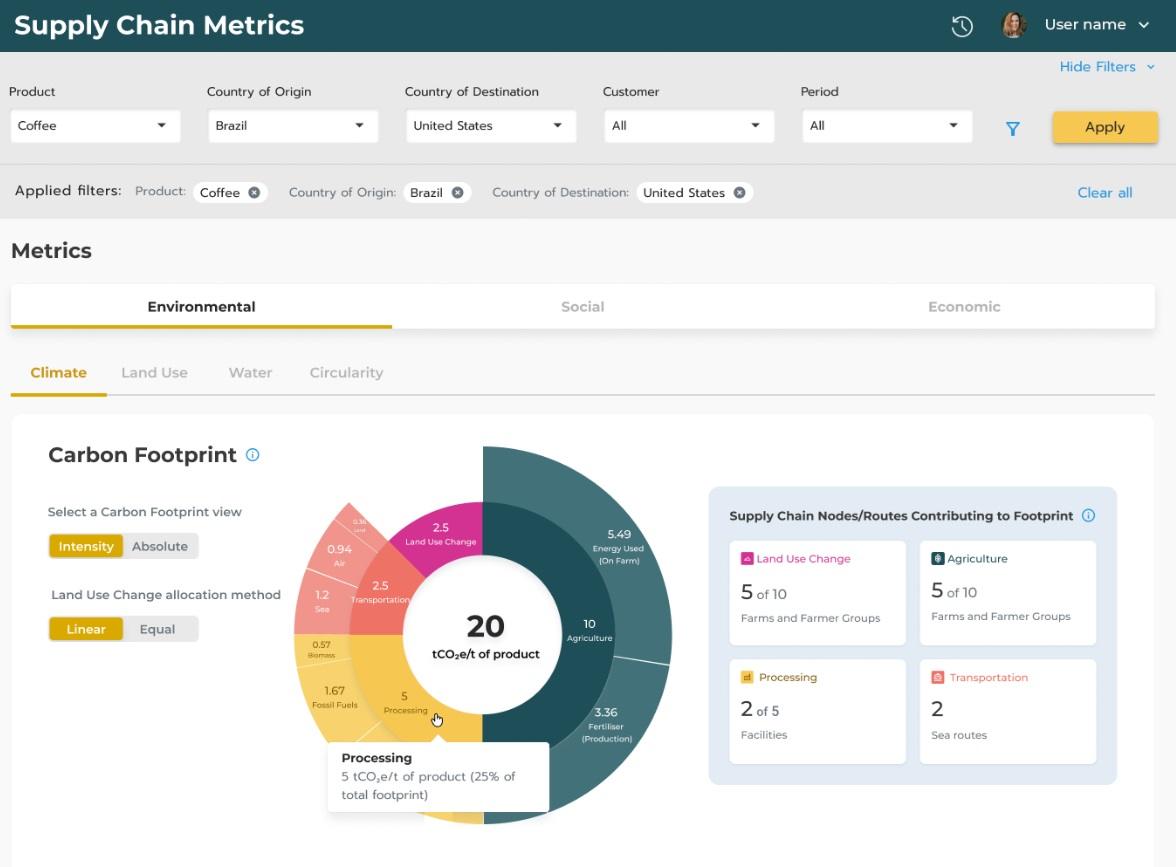

Launched with a $150 million commitment in 2021, SGE is J.P. Morgan Asset Management’s sustainability-focused late-stage venture and growth equity investment arm, focused on investing in best-in-class companies that drive resource efficiency and climate adaptation solutions across a range of industries that account for the bulk of greenhouse gas emissions, such as transportation and supply chain, real estate and the built environment, industrials and manufacturing, and food and agriculture.

Investments to date be SGE include mining-focused data solutions company MineSense Technologies, and utilities-focused climate tech data startup Arcadia.

Osei Van Horne, Managing Partner and Co-Global Head of Sustainable Growth Equity at J.P. Morgan Private Capital, said:

“J.P. Morgan is uniquely positioned to support and invest in the decarbonization of heavy industries – a multi-trillion-dollar market opportunity – and Alex’s depth of experience investing in climate solutions will be valuable to our investment team.”

Bell joins SGE from global alternative asset management group Tikehau Capital, where he served as Head of North America Climate Private Equity, with responsibility for all stages of investing across sourcing, diligence, structuring, execution and fundraising. Before joining Tikehau, he worked at Caisse de Dépôt et Placement du Québec (CDPQ), including as Director of Sustainable Investments, where he led investment efforts of CDPQ’s $500 million Innovation in Sustainable Investments platform, investing in late-stage VC and early growth companies in Sustainable Food & Agriculture, Energy Transition, and Circular Economy.

Tanya Barnes, Managing Partner and Co-Global Head of Sustainable Growth Equity at J.P. Morgan Private Capital, said:

“I’ve known Alex for nearly two decades and he is a pragmatic, values-driven investor who brings years of multi-asset class sustainable investing experience to the team.”

Brian Carlin, CEO of J.P. Morgan Private Capital, added:

“Alex is joining one of the most compelling and diverse teams in our business – executing on an investment strategy that is both timely and leverages the global scale, sustainability expertise and industry connectivity of JPMorgan Chase.”