Integrum ESG Launches SFDR Compliance Tool for Portfolio Managers

ESG data-focused software provider Integrum ESG announced today the launch of SFDR Compliance, a new solution aimed at enabling investment and managers to assess and report on their portfolios in line with upcoming EU Sustainable Finance Disclosure Regulation requirements.

The EU Sustainable Finance Disclosure Regulation (SFDR) establishes harmonized rules for financial market participants on transparency regarding the integration of sustainability risks and the consideration of adverse sustainability impacts in their processes and the provision of sustainability‐related information with respect to financial products.

In the upcoming phase of the regulation, set to come into effect in 2023, reporting obligations will include disclosures on the manner in which sustainability risks are integrated into investment decisions, and assessments of the likely impacts of sustainability risks on the returns of financial products, measurement and tracking of KPIs, principal adverse impacts (PAIs) and EU Taxonomy alignment.

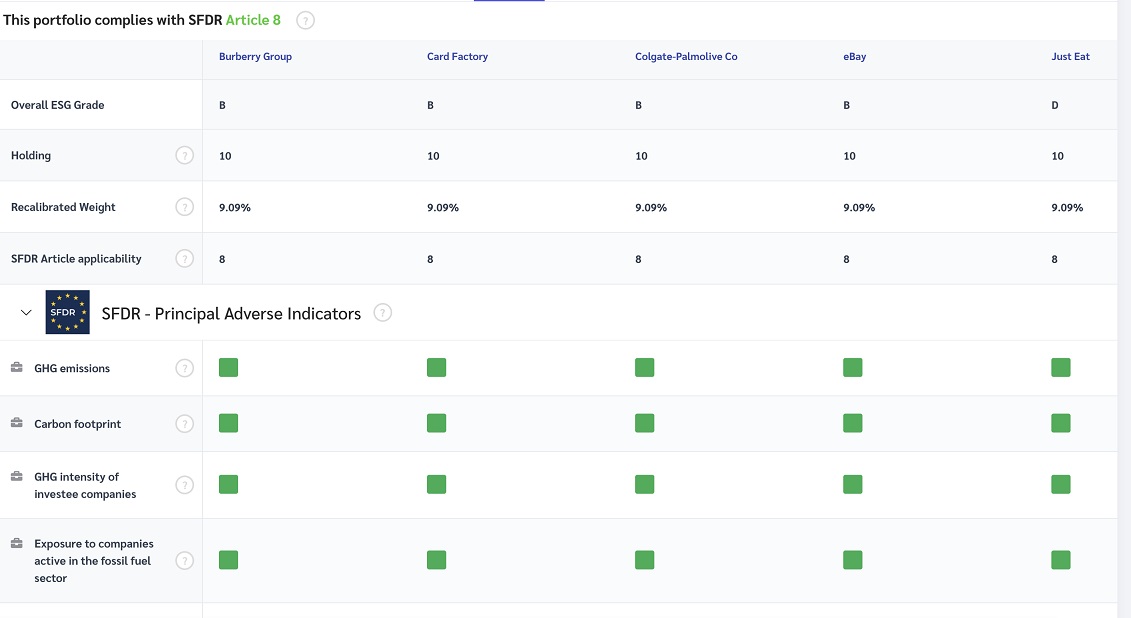

SFDR will require investment funds to be classified as Article 6, indicating that sustainability factors are not integrated into the investment process, Article 8, indicating that the funds promote environmental and/or social characteristics among other characteristics, or Article 9, which have sustainable investment as its objective. Article 8 or 9 status requires each holding in the fund to be mapped to a series of environmental and social PAIs.

Integrum’s new SFDR Compliance tool enables investment managers to load up their portfolios, which can be classified by the solution as Article 6, 8 or 9. Users will be able to analyze the SFDR attributes of every company in the portfolio, with transparency provided into each holding’s PAI assessment, and the raw data underlying the score provided.

The platform will also enable users to record and report on engagement efforts with companies with adverse sustainability impacts, meeting another SFDR rule requirement.

Shai Hill, CEO of Integrum ESG, remarked regarding the current state of the market –

“Many asset managers have already ‘self-classified’ funds they manage as Article 8. This is usually because they have adopted policies for the fund that ‘promote environmental and social objectives’. Such policies are indeed stipulated in the legislation.

“But an Article 8 or 9 fund also needs to have assessed every one of its holdings against 14 PAIs – so that a regulator can consider the extent to which any investment may be undermining the EU’s environmental and social objectives. It’s a detailed and tedious job – but that’s why we have created this tool that does it for you.”