Guest Post: Markets Must Brace for Hard-Hitting ESG Regulation

By Inna Amesheva, Director in ESG Research, Arabesque S-Ray

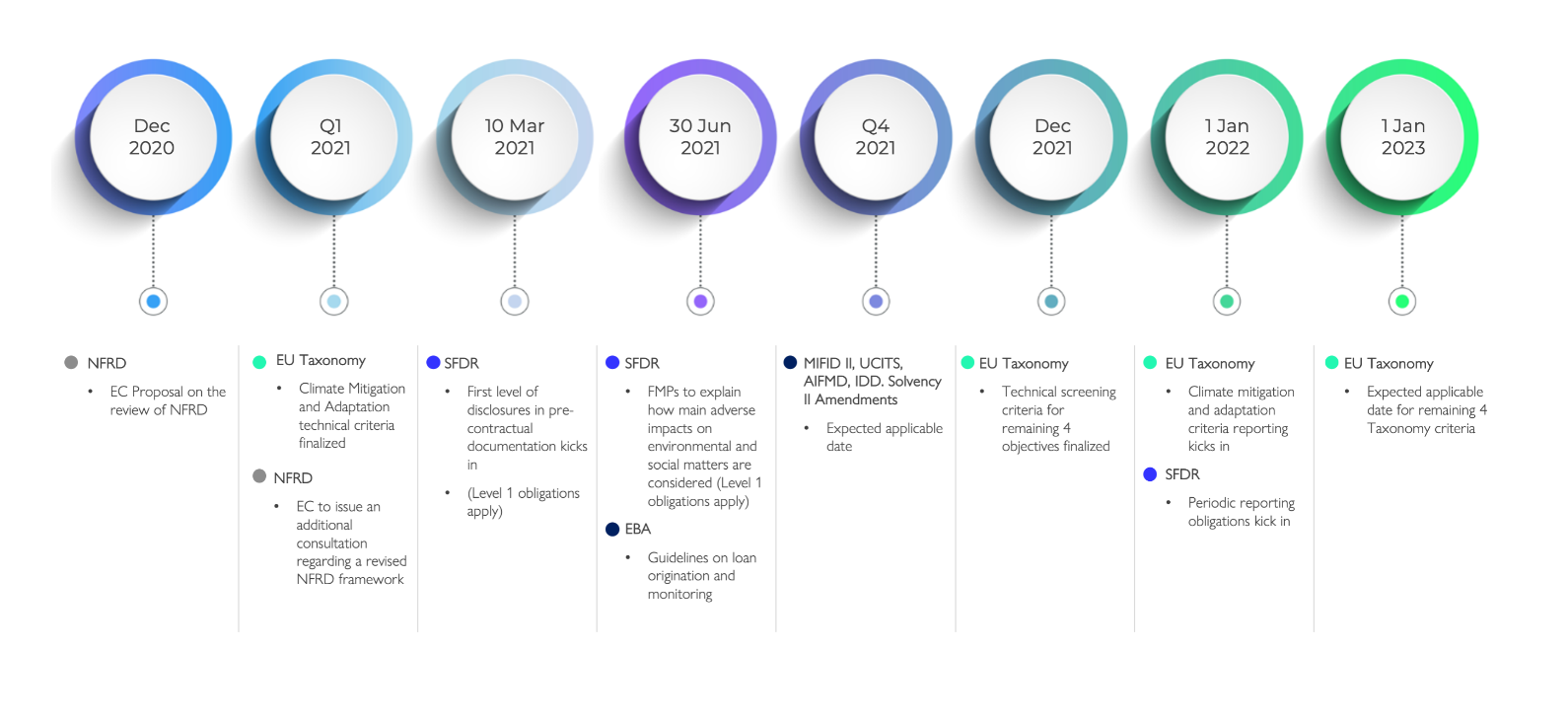

Last week marked an important milestone for financial markets across the EU, as the long-anticipated Sustainable Finance Disclosure Regulation (SFDR) came into effect on Wednesday (10th March 2021). This signifies a step change in how investors’ sustainability commitments are measured and tested. It also makes the way in which companies gather, analyse and report sustainability data absolutely crucial in the coming years, as investor pressure mounts towards more granular data disclosures.

Under the new regulations, asset managers and other entities offering financial products in the European Union will need to implement a due diligence policy which evaluates the adverse impacts of investment decisions on environmental, social and governance commitments. These measures demanding greater transparency and accountability are welcome, not to say long overdue. The sustainability data landscape of today is similar to the financial data landscape of a century ago; a ‘wild west’ of reporting standards, where a common and easily comparable reporting framework remains lacking, and most existing ESG disclosures are implemented on a voluntary basis.

In financial reporting, the situation changed with the establishment of common financial reporting standards, which later evolved into IFRS and US GAAP. Now, sustainable investing looks set to follow suit. Globally, legislators are introducing a suite of fast-evolving extra-financial disclosure requirements that encompass the entire ecosystem of market participants. These early measures are really the thin end of the wedge; companies will only face increasing scrutiny over the next few years. This means that having a strong and reliable underlying data infrastructure will be important for businesses to meet regulatory deadlines, and report detailed sustainability information at scale.

Notably, the EU Disclosure Regulation (SFDR) is applicable to all financial market players, regardless of whether they purport to be offering sustainability-related products or not. The SFDR is hence an important part of the EU’s bold legislative strategy to make sustainability considerations a fundamental pillar of regulation in the financial services industry.

This means that both investors and corporates must move fast. It takes time for companies to identify and report granular ESG data to stakeholders, who then in turn have to aggregate, compare and analyse the information before they can report it to regulators. The earlier this process is initiated, the better in terms of data-readiness, so that the affected stakeholders can avoid last-minute time pressure in having to find an effective data reporting approach.

Failure to prepare bears real consequences, too. Companies not meeting their sustainability disclosure targets will suffer a hefty reputational impact, and even financial penalties which might be applicable across more stringent national jurisdictions. Companies that fall behind risk staying behind: as of January 2022, investors will have to report against a range of quantitative sustainability indicators and disclosure metrics. Asset managers are strongly advised to review the extent of applicable disclosures now, when making the relevant updates to their data collection and reporting practices.

What is clear from recent developments in ESG regulation is that the ever-growing complexity of data and reporting requirements has created a demand for adaptive and scalable data solutions.

Such solutions must enable market players to easily collect, analyse and integrate sustainability information into their reporting and investment practices. Indeed, in the absence of efficient technology and analytics tools, which underpin the granular data disclosures demanded by regulators, markets will be left to identify and action the relevant information disclosures themselves. Hence, the collaboration and engagement between investors, corporates, ESG data providers and regulators will be crucial in improving sustainability data transparency in the twenty-first century.

Collaborative, multi-stakeholder dialogue between reporting entities, technology and ESG data providers, as well as the legislative bodies themselves, should be at the heart of achieving the intended objectives of the forthcoming legislative measures. Namely, introducing more transparency, avoiding greenwashing and fully integrating sustainability factors into risk management and financial decision-making.

In light of these new regulatory milestones, poised to transform the current ESG landscape, we are introducing a suite of data and technology-based offerings for our clients. A significantly improved state of sustainability data would have to become the norm, if we want truly prepared financial markets across the EU as the ‘wild west’ ends, and a brave new world of impactful regulation takes hold.

About the Author:

Inna Amesheva is Arabesque’s director of ESG research and regulatory solutions. She previously was a mentor and senior advisor for the United Nations’ youth network for Sustainable Development Solutions. Inna has also built and scaled a number of start-ups across Europe and Asia.