Goldman Sachs Launches Analytics Solution to Measure & Manage Portfolio Carbon Emissions Exposure

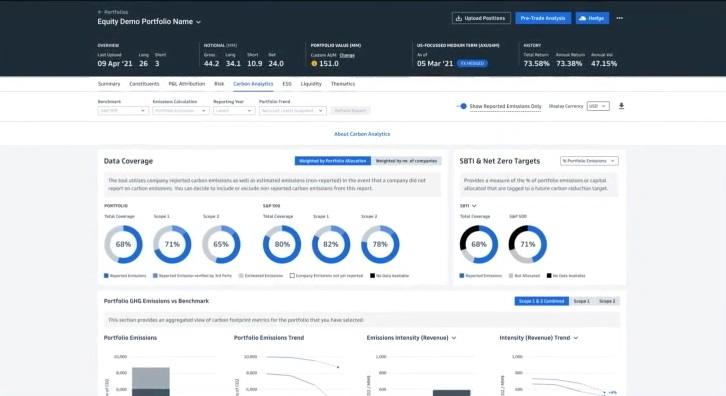

Goldman Sachs announced today the launch of Carbon Portfolio Analytics, a new analytics application aiming to enable clients to assess, analyze and manage the carbon exposure of their public equity and corporate bond portfolios. The solution is available on Marquee, the firm’s digital marketplace for institutional investors.

According to Goldman Sachs, the new tool will help clients to make informed investment decisions toward achieving their portfolio decarbonization goals.

John Goldstein, head of Goldman Sachs’ Sustainable Finance Group, said:

“Central to our work accelerating climate transition is arming our clients with the tools to measure and manage their own decarbonization. We’re excited to offer this innovative product to our clients, as we continue to integrate sustainable solutions into all of our businesses.”

Features of the new solution include the ability to analyze the carbon footprint of public equity and corporate bond portfolios, including scope 1 and 2 emissions data, carbon intensity levels and decarbonization targets, to compare carbon emissions against a chosen benchmark in order to understand the main contributors by sector, industry and region, and to compare the carbon intensity levels of different companies.

Goldman Sachs stated that the analytics have been defined in line with global standards such as TCFD and EU SFDR.

Sarah Lawlor, COO of Goldman Sachs’ Global Markets sustainable solutions council, said:

“The path to de-carbonization requires not just the right intentions, but good data and analytics to help manage and measure progress. Many of our clients have made commitments to transition their investment portfolios to net zero emissions over time. To deliver positive results for investors & the planet, and manage risk appropriately Goldman Sachs’ Global Markets Division is equipping their clients with relevant insights, analytics and solutions.”

Anne Marie Darling, Head of Marquee Distribution, added;

“Both GS and many of our clients strongly believe that the financial services industry must play a pivotal role in building a sustainable future. Enabling our clients to make more environmentally accountable decisions, and commit capital accordingly, is an essential and urgently required next step in the global response.”