EY Study Explores Sustainability Implications of US Election on Corporate Sustainability Strategy

A study conducted by Ernst & Young LLP (EY) found that in the wake of the recent US presidential election, US executives are expecting sustainability regulations to have a significant impact on business strategy, with many concerned about their companies’ ability to respond to upcoming ESG requirements.

EY’s Election Pulse Strategy Survey polled 500 US C-level and executive decision-makers at companies with more than $1 billion in annual revenue, in October 2020. According to EY, the survey explored the potential implications of each presidential administration’s policies on business strategy and execution.

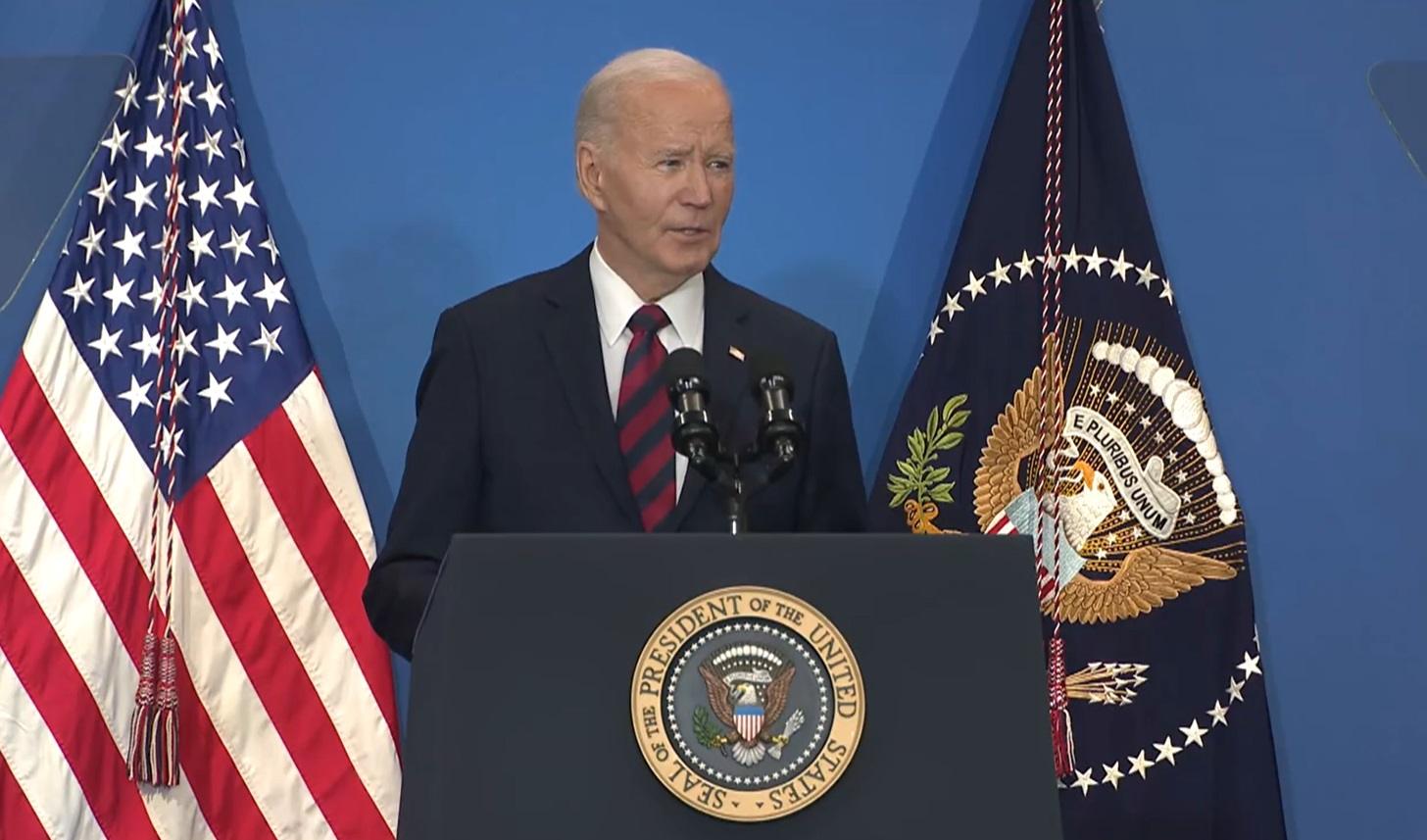

The incoming Biden administration is likely to be very active on the sustainability front. Immediately following the US election, President-elect Biden vowed to return the US to the landmark Paris Agreement on his first day in office, in response to President Trump’s withdrawal from the accord. The Biden transition team has introduced an ambitious climate plan, suggesting major investments in renewables, infrastructure and other areas. In the aftermath of the vote, several ESG investors and organizations have issued statements welcoming the new administration and its sustainability focus.

While investors appear enthusiastic following the election, however, companies appear to be concerned regarding the upcoming changes in sustainability regulation. The EY survey finds that nearly every executive expects to see sustainability issues having a significant impact on their businesses, with 96% indicating that their current portfolio strategy will be affected, and nearly half (47%) reported that it will be difficult for their organizations to respond to increased regulation on environmental and sustainability practices.

Interestingly, the survey found a significant difference in attitude toward the coming ESG regulatory changes by enterprise size. According to EY, while 86% of leaders at companies between $1 billion and $5 billion in revenue indicated that it would be easy to respond, 70% of leaders at companies with $10 billion or more in revenue indicate it would be difficult.

Bill Casey, EY Americas Vice Chair, Strategy and Transactions, said:

“There’s a growing focus on nonfinancial performance and value creation metrics from investors and consumers as companies are expected to be global corporate stewards. To meet those demands, we found that 44% of companies are looking to form coalitions with corporate customers, suppliers and competitors, and an equal amount are making changes internally through new investments in clean, sustainable assets. But no one thinks it will be easy.”