ESG Book Launches Fund Sustainability Scoring Solution

Fund research indicates major indices are not on track to hit global climate goals

Sustainability data and technology company ESG Book announced the launch of Fund Scores, a new solution aimed at enabling investors to analyze and compare the sustainability profiles of thousands of funds.

ESG Book, formerly Arabesque S-Ray, is a digital platform for ESG data management, disclosure, and analytics. The company stated that the Fund Scores launch forms part of its initiative to scale its services globally, as client demand for technology enabled ESG data solutions increases. ESG Book recently raised $35 million to help advance these efforts, an earlier this month, the company hired LSEG’s former Head of Research and Portfolio Management, Leon Saunders Calvert as Chief Product Officer to lead the expansion of ESG Book’s product suite.

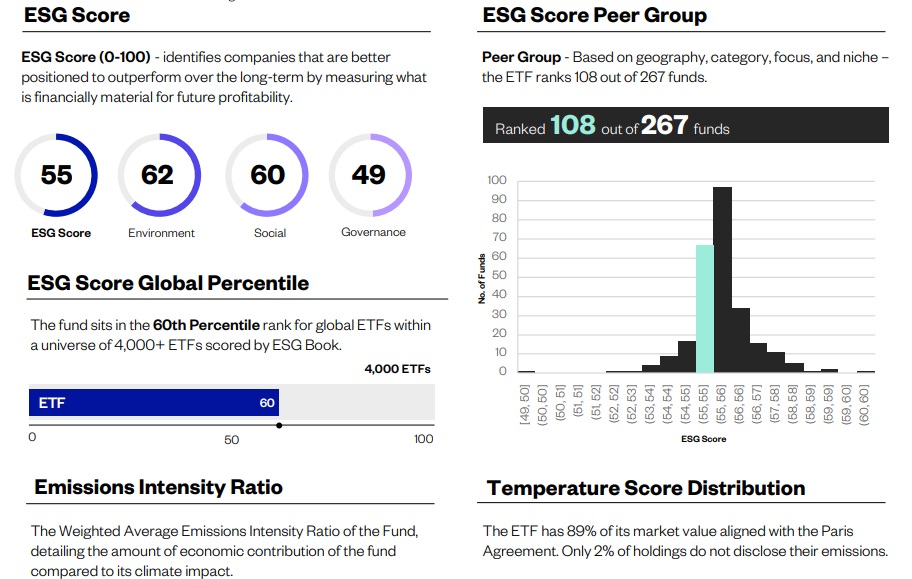

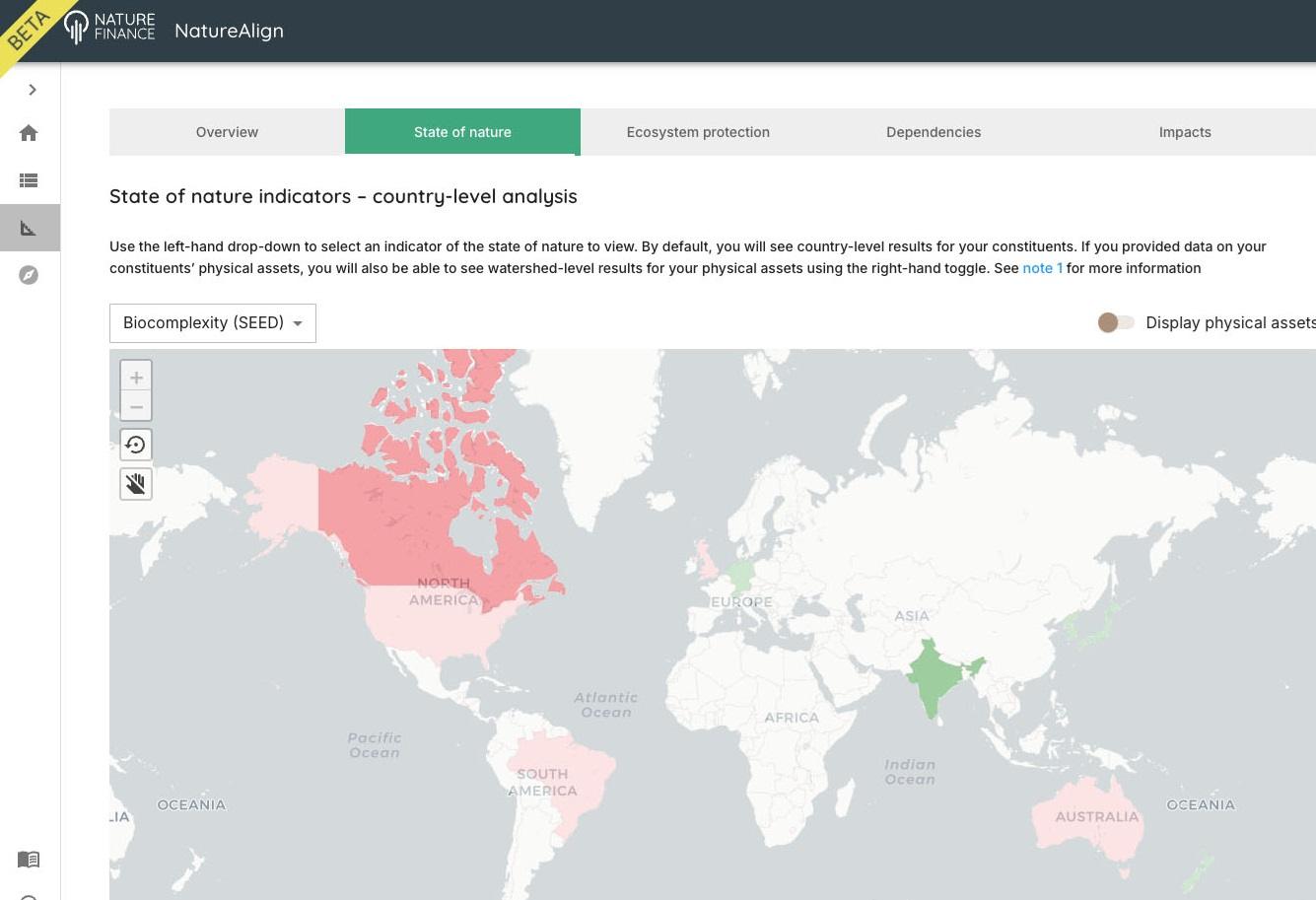

The new solution provides coverage of over 30,000 mutual funds and 4,000 ETFs across equity, corporate fixed income and hybrid investment strategies, and provides sustainability metrics including ESG scores on 22 topics, UN Global Compact scores, climate scores, and emissions intensity ratios.

Along with the launch, ESG Book provided data on the climate profile of the world’s largest funds, indicating that currently, none of the world’s major indices are on track to align with the global goal to limit warming below 1.5 degrees Celsius by 2050. Among the major world indices, Australia’s ASX was found to have the highest emissions intensity ratio (EIR) of 327 tons per million dollars of revenue, driven largely by its exposure to the utilities and energy minerals sectors, while the Dow Jones Industrial Average has the lowest EIR of 40 tons, with greater exposure to the finance, retail trade and technology services sectors.

Dr Daniel Klier, CEO of ESG Book, said:

“Current events give a stark reminder of the urgent need to transition to a net-zero pathway. However, markets still lack the accurate information required to allocate capital more effectively to sustainable, higher impact assets. Consistent, transparent, and accessible data can provide a solution. ESG Book’s new Fund Scores will enable clients to gain a clearer view of the ESG performance of over 35,000 funds globally, providing the transparency that investors need to make informed decisions for a more sustainable future.”