Citi Ventures, IKEA Parent Ingka Invest in Consumer Carbon Footprint Tracking Solution Provider Doconomy

Stockholm-based applied impact solutions startup Doconomy announced the completion of a $19 million equity funding round, with proceeds aimed at helping the company reach its goal to help one billion people each cut one tonne of carbon emissions per year.

The funding round was led by Commerzbank-related VC CommerzVentures, with participation from new investors Ingka Investments (part of IKEA parent Ingka Group) and Citi Ventures, as well as existing investors Mastercard and Ålandsbanken.

Johan Pihl, co-founder and CIO of Doconomy, said:

“This new funding from Ingka Investments and Citi Ventures represents an exciting vote of confidence and a major reinforcement of Doconomy’s ability to introduce impact metrics as a tangible and actionable way for millions of users to understand and reduce their environmental impact.”

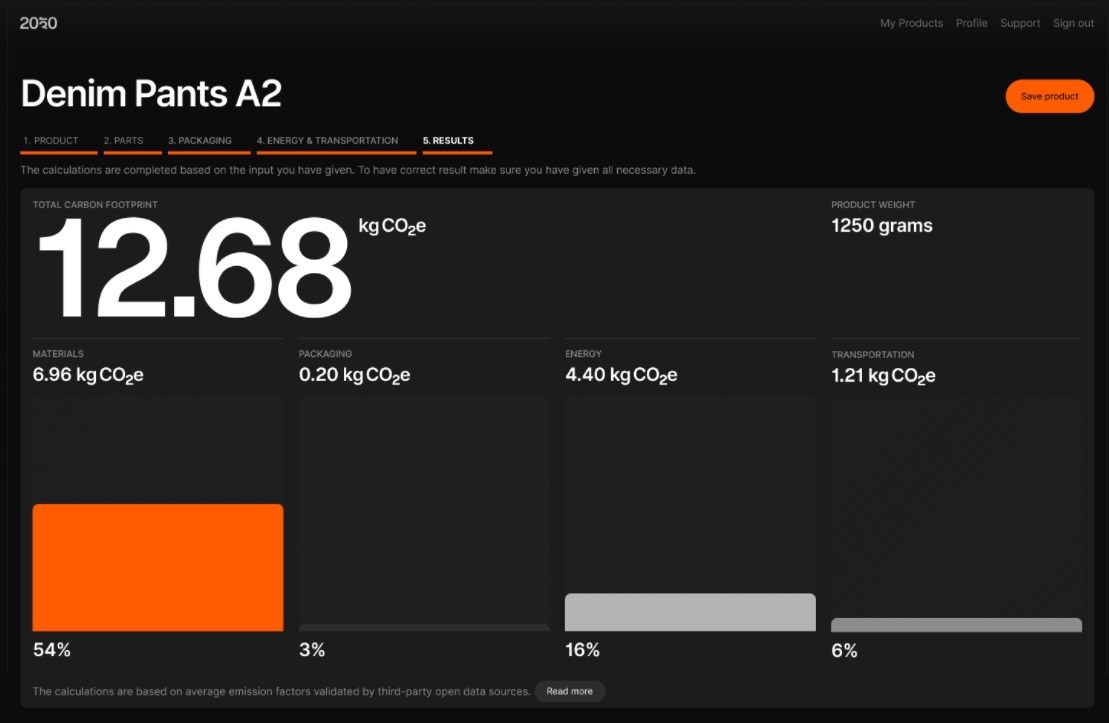

Doconomy’s solutions help consumers to measure and understand the environmental impact of their transactions, enabling more sustainable choices. Solutions include the financial transaction API, which allows companies such as Mastercard to enable customers to track the environmental footprint of each purchase they make and set individual carbon budgets, the 2030 calculator, which allows brands to quantify the carbon footprint of the products they manufacture using a common universal scoring system.

According to Doconomy, proceeds from the financing will be used to accelerate the company’s expansion, recruit new talent, and support the further development of its Impact Applied portfolio.

Mathias Wikström, co-founder and CEO of Doconomym said:

“With Doconomy the power of the conscious consumer is unleashed. Corporates are increasingly acting on the much needed shift to greater transparency and Doconomy facilitates this at the corporate and product level to empower behaviour change. In addition to the coalition of corporate climate champions that already work with Doconomy, we are thrilled to have the support of corporate venture teams at Ingka Group and Citi who recognize the potential and urgency of our mission.”

Jelena Zec, SVP, Venture Investing at Citi Ventures, added:

“As corporates and financial institutions work towards a net-zero carbon future, climate fintechs that leverage data and technology to measure environmental impact can help accelerate those efforts and provide a strategic advantage. Citi Ventures has been impressed by Doconomy’s team, proprietary methodology and proven ability to build partnerships to deliver tangible climate action. We look forward to supporting them as they develop actionable solutions to help companies, institutions and consumers address climate change.”