Arabesque Launches AI-Powered Active Asset Management Platform Enabling Tailored ESG Strategies

ESG-focused financial technology company Arabesque announced the launch of AutoCIO, its new AI-powered autonomous asset management platform, aimed at enabling the creation of highly customised and sustainable active investment strategies.

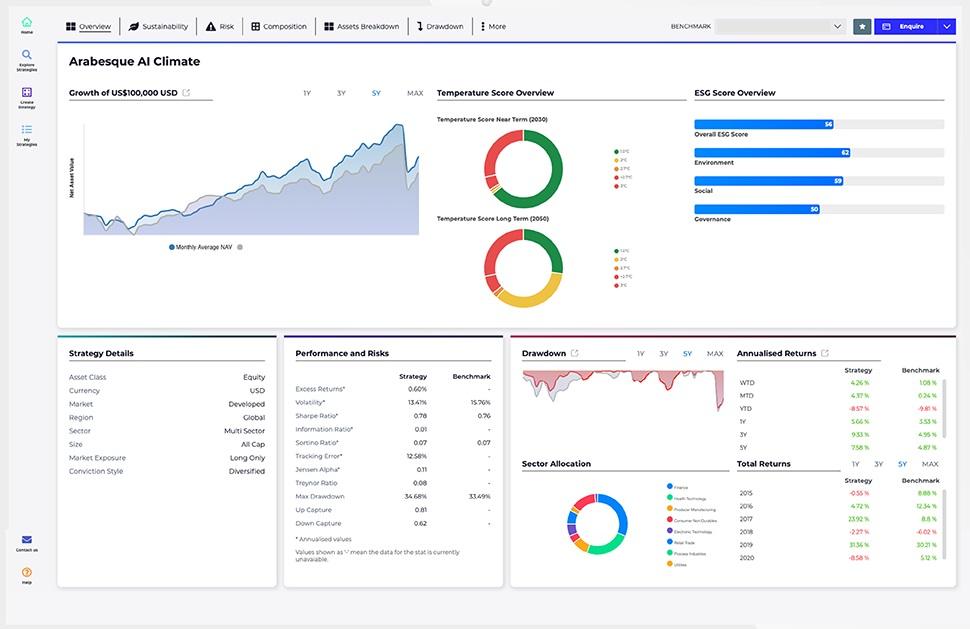

Developed by Arabesque’s artificial intelligence-focused business, Arabesque AI, the new platform is designed to enable asset managers to build active, alpha-generating investment strategies that are highly customised to meet clients’ sustainability and investment objectives, such as climate targets, ESG criteria and risk/return profiles.

AutoCIO provides access to over 4 million strategies, and enables clients to calibrate strategies utilizing thousands of personal investment and sustainability criteria. Additionally, the platform includes the ability to back-test a strategy’s performance and compare against other strategies and benchmarks.

Arabesque stated that the company’s AI Engine powering AutoCIO is run on carbon-neutral Google Cloud infrastructure.

Georg Kell, Chairman of the Arabesque Group, said:

“Whilst the market is increasingly demanding sustainable products that align with the objectives and values of investors, asset managers are currently unable to offer customisable, active solutions at scale. Investment firms face a fast-changing landscape where many traditional products, tools and approaches are no longer as relevant as they once were.

“AutoCIO is a game-changing solution that can enable asset managers to deliver an enormous range of highly customised ESG investment strategies in a cost-efficient and scalable way. Sustainability issues are fast becoming a global priority, and new technologies like this will empower many more investors to participate.”

Dr Yasin Rosowsky, CEO of Arabesque AI, added:

“Asset managers today increasingly need to personalise products and services at scale to focus on customised strategies that incorporate investors’ sustainability objectives and values.

“We use the power of AI to build systems capable of handling the complexity of financial data and enable scalable investment process design for a wide variety of use cases in an efficient and cost-effective way. This is not a robo or passive investment solution, but fully active asset management, powered by AI.

“We are excited to bring AutoCIO to the market and provide asset managers and investment professionals with a scalable, digital tool to build actively managed, customised solutions that meet their clients’ sustainability goals.”