Persefoni Launching Financed and Portfolio Emissions Analytics Suite for Banks, Investors

Climate management and accounting platform (CMAP) provider Persefoni announced today plans to launch the Persefoni Portfolio Analytics Suite, a new toolset of solutions and dashboards aimed at enabling financial institutions to track, manage and reduce the greenhouse gas emissions associated with their investment portfolios and financing activities.

The launch comes as banks, investors, insurance companies and asset managers are facing increasing pressure from regulators and other stakeholders to address their climate impacts, and to begin to put their net zero plans into action. Financing and investing activities typically make up the vast majority of financial institutions’ climate impact, with financed emissions often hundreds of times greater than operational emissions. Recent studies, however, indicate that most financial firms are still at the early stages of assessing their own climate exposure, and even environmentally-focused funds are behind on their emissions reduction targets.

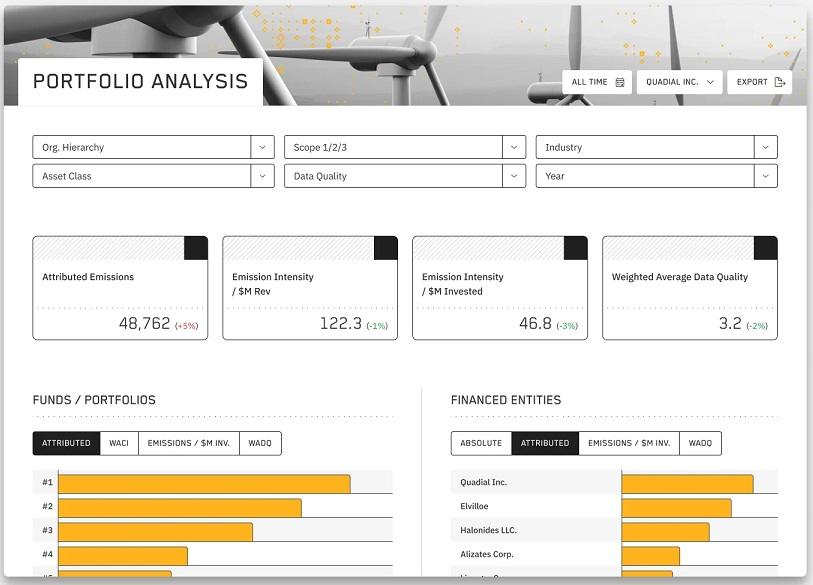

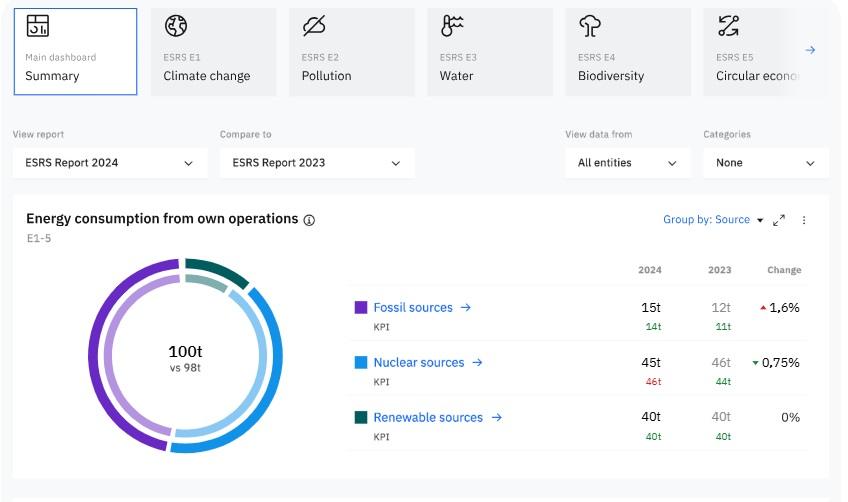

The new solutions suite includes a series of dashboards, providing financial professional with insights into areas including decarbonization pathways, climate transition risk assessment and portfolio construction. The dashboards include ‘Value at Risk from Transition,’ enabling assessment of portfolio risk associated with the transitional impacts of climate change; ‘Portfolio Decarbonization,’ allowing users to model the impact of various decarbonization strategies; ‘Estimates vs. Actuals,’ comparing estimated and actual portfolio emissions; ‘Portfolio Builder,’ enabling investors assess emissions for a model or existing portfolio; ‘Carbon-Adjusted Return Analysis,’ analyzing the return impact of factors including carbon pricing and decarbonization costs, and; ‘Side-by-Side Comparison,’ providing financed emissions comparisons by fund, company, or portfolios over time.

The suite also includes Climate Impact Benchmarking (CIB), a module launched last month by Persefoni, enabling investors to prioritize investment portfolio allocations by setting emissions intensity and carbon performance benchmarks by country and sector average, and Portfolio Impact Benchmarking (PIB), which will allow users to measure fund or portfolio emissions with equity and fixed income indices.