ICE Launches Data Solution to Help Investors Meet SFDR Requirements

Global exchange and clearing house operator Intercontinental Exchange (ICE) announced today the launch of the ICE’S SFDR PAI Solution, a new data solution aimed at helping investors meet the EU Sustainable Finance Disclosure Regulation (EU SFDR)

The EU SFDR, part of the EU’s Action Plan on financing sustainable growth, establishes harmonized rules for financial market participants including investors and advisers on transparency regarding the integration of sustainability risks and the consideration of adverse sustainability impacts in their processes and the provision of sustainability‐related information with respect to financial products.

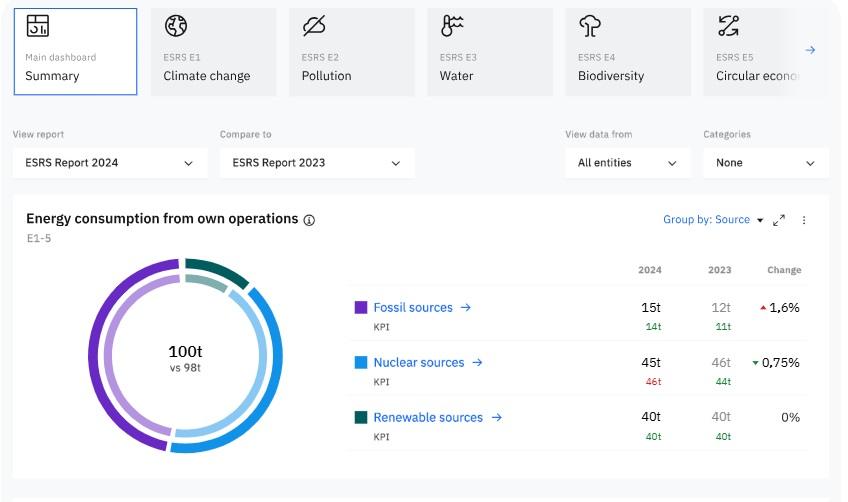

In the upcoming phase of the regulation, set to come into effect in 2023, reporting obligations will include providing disclosures such as the manner in which sustainability risks are integrated into investment decisions, and assessments of the likely impacts of sustainability risks on the returns of financial products, measurement and tracking of KPIs, principal adverse impacts (PAIs) and EU Taxonomy alignment.

Features of ICE’s new solution include event-triggered updates for all of the mandatory adverse sustainability indicators applicable to investments in companies, sovereigns and supranationals, along with formatted disclosures on ESG indicators, including greenhouse gas emissions, board gender diversity, energy consumption ratios, required by the EU’s PAI regime. The service also enables customers to link equity and fixed income securities to the closest disclosing corporate entity.

Elizabeth King, President of ESG and Chief Regulatory Officer at ICE, said:

“The transparency ambitions of the EU SFDR places new demands on asset managers and investment advisers. ICE’s SFDR PAI Solution offers updated, granular values for the SFDR’s adverse sustainability indicators needed by market participants to meet SFDR requirements.”