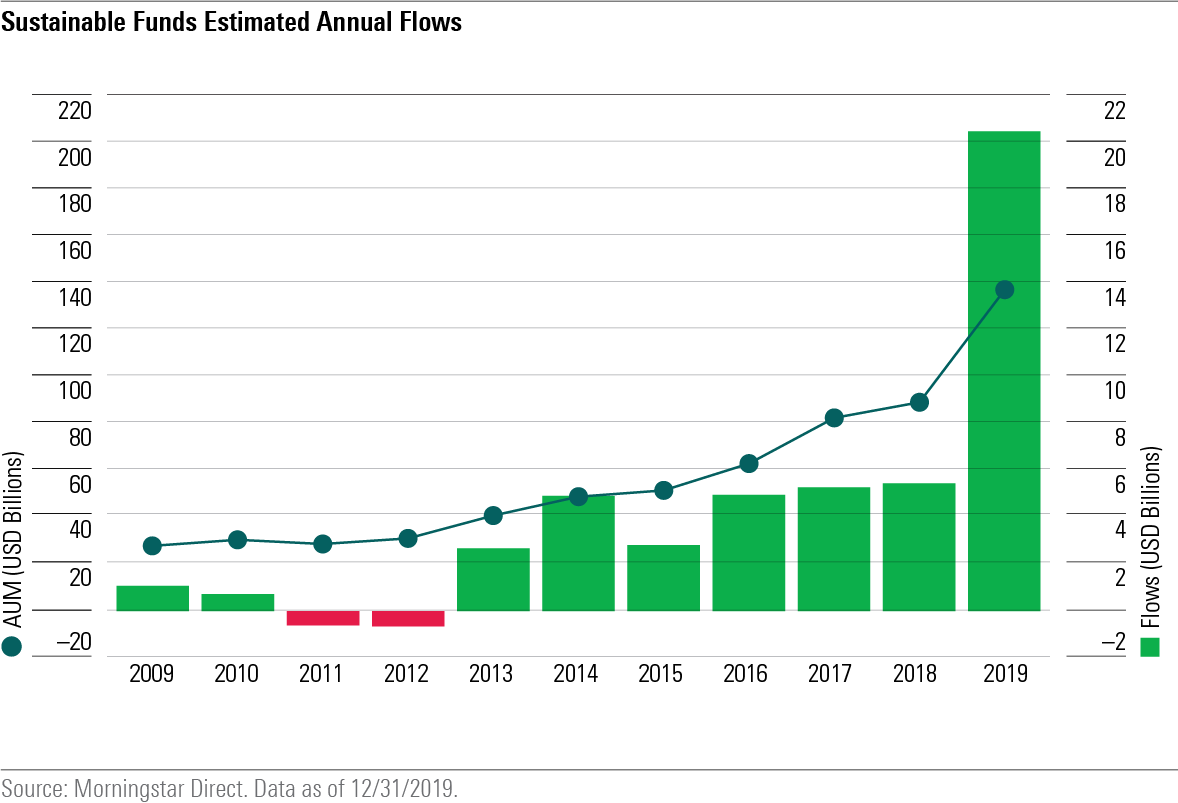

U.S. ESG Fund Flows Break Records in 2019

Net flows nearly 4x prior record

Investor demand for ESG strategies is finally gaining ground in the U.S. According to Morningstar data, flows into funds with sustainable investing strategies smashed previous records in the U.S. in 2019. Net flows into mutual and exchange traded sustainable funds reached an estimated $20.6 billion last year, nearly 4 times the previous record set in 2018.

Breaking down the data by quarters suggests an even more bullish trend for sustainable investing in the U.S. Flows increased throughout last year, growing from roughly $4 billion in the first quarter of the year, to over $7 billion in Q4.

U.S. still far behind Europe

Although the growth in ESG fund flows is impressive, we note that the U.S. still lags far behind Europe in adopting ESG principles in investing. In just the first 9 months of 2019, Morningstar reports that flows into European ETFs and mutual funds reached EUR 70.4 billion, representing fully 39% of total European fund flows.