Merger of S&P Global and IHS Markit Creates ESG Data Powerhouse

Leading market data companies S&P Global and IHS Markit announced this morning a definitive merger agreement, combining the companies in a transaction valuing IHS Markit at an enterprise value of $44 billion. From the perspective of ESG investors, the merger creates a powerhouse in terms of ESG, climate and energy transition data, services and tools.

S&P is a world leader in sustainable investing data and services, including its preeminent Dow Jones Sustainability World Index, the S&P Global ESG Scores, powered by the SAM Corporate Sustainability Assessment (CSA), and other offerings including the Essential Climate Analytics and Positive Impact Analytics services, among many others.

IHS brings a broad suite of ESG capabilities to the table as well, including its ESG Reporting Repository, a suite of sustainable fixed income indices, a liquid tradeable global index for tracking carbon credits, numerous ESG and Corporate Governance IR solutions, and its recently introduced sovereign ESG data solutions, among others.

On a conference call discussing the transaction, S&P Global CEO Douglas Peterson and CFO Ewout Steenbergen called out some of the areas of greatest opportunity and secular trends driving the acquisition. Some of the “most exciting” opportunities identified on the call revolved around the combined company’s enhanced capabilities in the areas of ESG and energy transition data services.

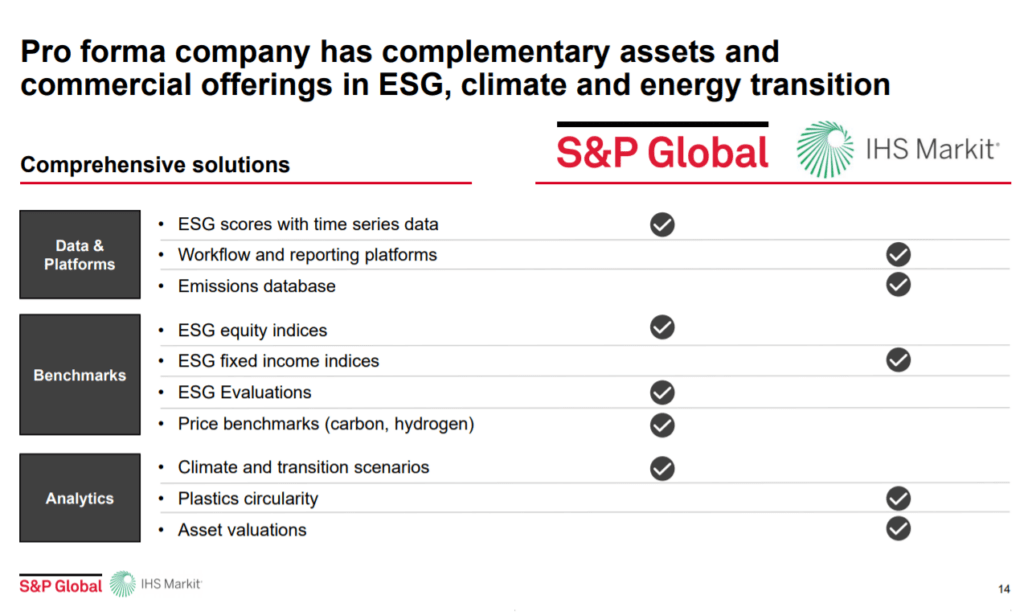

The companies also highlighted their complimentary ESG, climate and energy transition capabilities. On the Data and Platforms side, the merger brings together S&P’s ESG scores offerings with IHS Markit’s workflow and reporting platforms, and emissions database. S&P provides ESG equity indices and pricing benchmarks for energy transition factors including carbon and hydrogen, matching well with IHS’ ESG fixed income indices.

Peterson said:

“Through this exciting combination, we are able to better serve our markets and customers by creating new value and insights. This merger increases scale while rounding out our combined capabilities, and accelerates and amplifies our ability to deliver customers the essential intelligence needed to make decisions with conviction. We are confident that the strengths of S&P Global and IHS Markit will enable meaningful growth and create attractive value for all stakeholders. We have been impressed by the IHS Markit team and look forward to welcoming the talented IHS Markit employees to S&P Global.”