Climate Risk Assessment Platform Climate X Raises $18 Million

Climate risk intelligence company Climate X announced today that it has raised $18 million in a Series A round, with proceeds aimed at accelerating its global expansion.

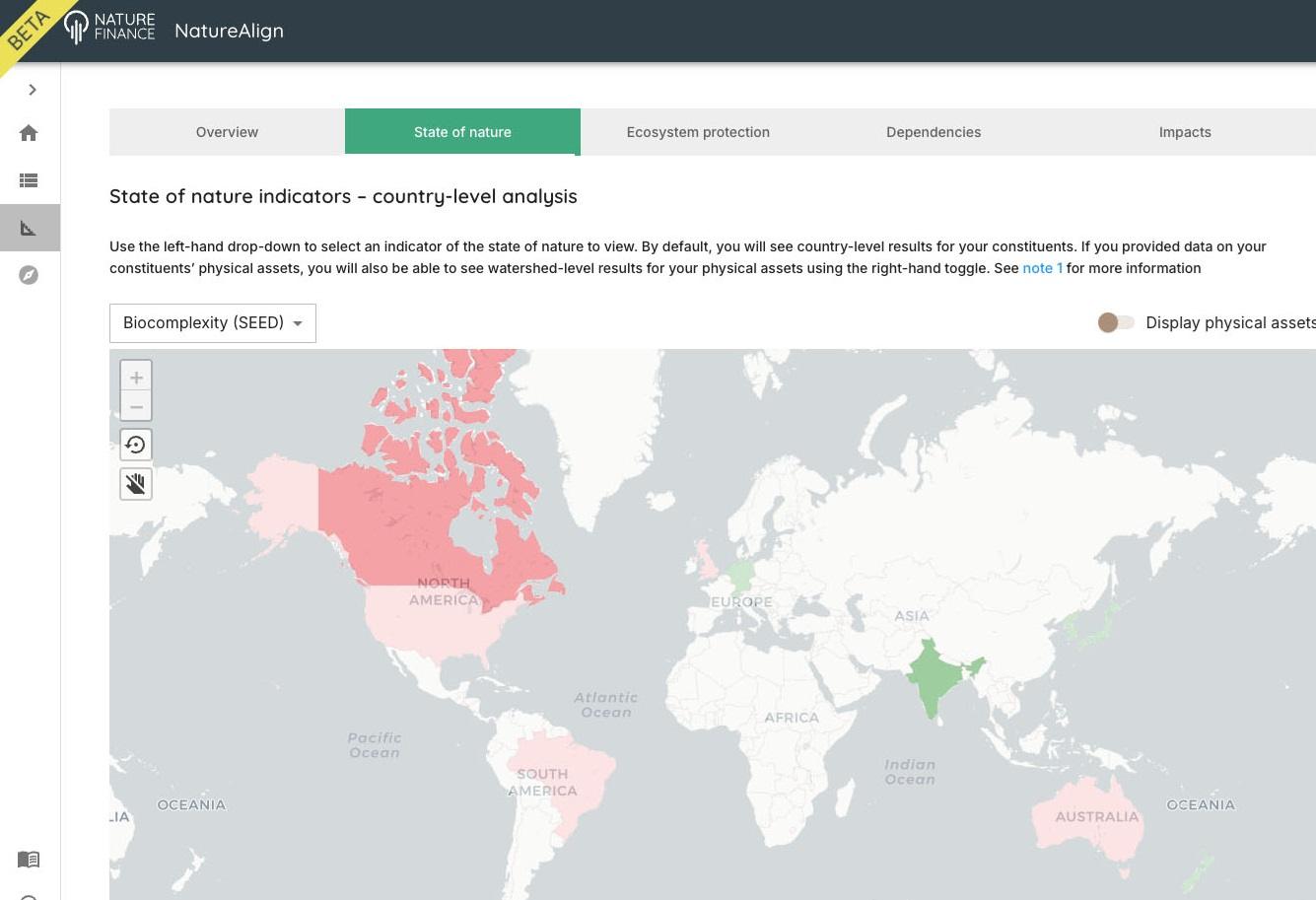

Founded in 2020 by CEO Lukky Ahmed and COO Kamil Kluza, UK-headquartered Climate X provides solutions aimed at helping financial institutions price the impact of climate risk across their physical portfolios. The company’s platform uses AI and digital twin technology to allow clients to model the likelihood of 16 different climate hazards—from extreme heat to tropical cyclones and flooding—across eight warming scenarios over a 100-year time horizon, down to the individual asset level. It then translates these risks into expected annual losses to determine the ROI of taking pre-emptive climate adaptation action based on a range of 22 different interventions.

Climate X said that it will use the new capital to accelerate its expansion in Europe, North America, and the Asian-Pacific region, as well as to build out the commercial team in its recently opened New York office, and to incorporate additional data sources into its platform to meet evolving commercial and regulatory requirements.

Lukky Ahmed, CEO at Climate X, said:

“In just over one year since going to market, Climate X has become one of the world’s fastest growing providers of physical climate risk data and analytics, driving value for global financial services clients with over $6.5 trillion in combined AUM. Assessing the impact of physical climate risk on asset valuations and business operations is now a necessity, not a nice-to-have.”

GV (Google Ventures) led the round, with participation from existing investors supported by Pale blue dot, CommerzVentures, noa VC and Blue Wire Capital, and new investors PT1, Unconventional Ventures and Western Technology Investment (WTI).

Roni Hiranand, Principal at GV, said:

“We’re excited to support the Climate X team as they work towards a vision of becoming the backbone for all climate risk-related decision-making within financial organisations.”