Finastra, Green RWA Launch Climate Risk Management Platform for Banks

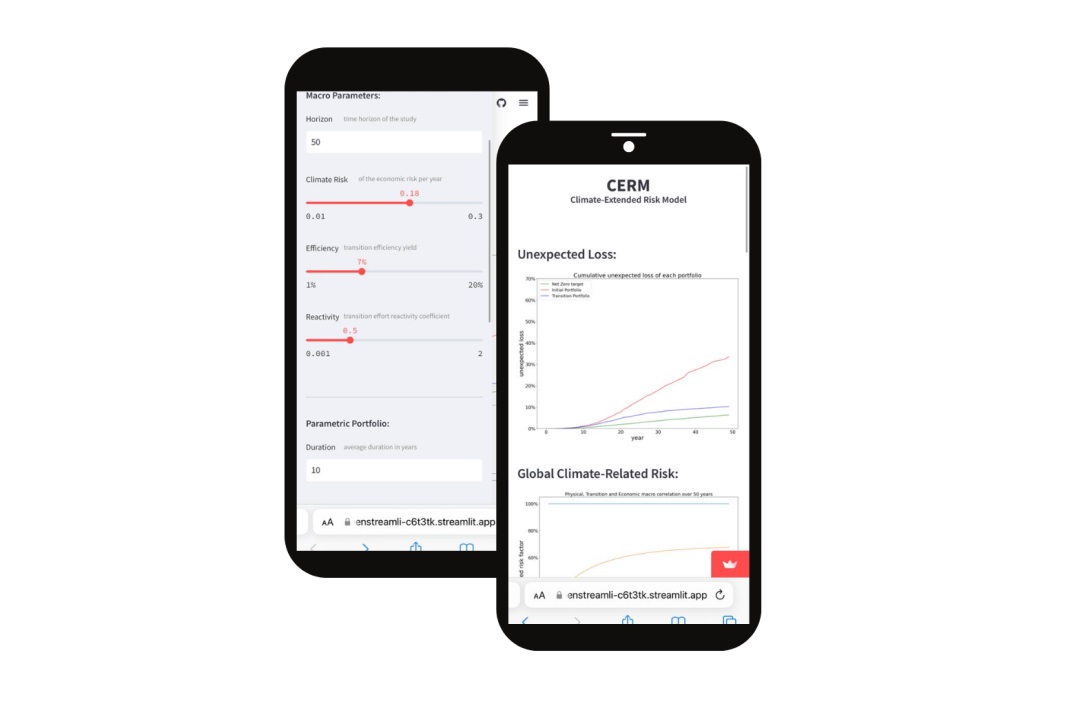

Financial software company Finastra and climate transition non-profit Green RWA announced today the launch of the Climate-Extended Risk Model (CERM) Sandbox, an interactive platform aimed at helping banks understand and manage climate risks.

Chirine BenZaied-Bourgerie, Head of Innovation at Finastra, said:

“Partnering with Green RWA is one of Finastra’s contributions towards providing the industry with tools for better climate risk management. By bringing the Sandbox to the community, we are helping the global banking industry effectively manage the impact of climate risks in their lending portfolios.”

The Climate-Extended Risk Model, or CERM, is a risk framework designed to enhance financial institutions’ resilience to climate change, and aimed at integrating climate risks into the existing regulatory framework, through credit risk models used by banks to assess lending portfolios’ expected losses. The framework incorporates physical risks, such as exposure of assets to climate-related events, and transition risks, including the costs to mitigate carbon emissions, and adapt to a low-carbon economy.

The new solution helps integrate CERM into banks’ existing capital framework, to help identify long-term, global, and evolving climate risks, and more accurately calculate potential losses.

Olivier Vinciguerra, Chair of Green RWA, said:

“By launching the CERM Sandbox, we aim to provide the finance industry with a comprehensive approach to understanding and managing climate-related financial risks at the highest level. This is a huge achievement, in line with Green RWA’s goal to support energy transition financing, and I want to thank Finastra for its support on that journey.”