6x More Carbon Capture Projects Planned than Currently Exist, Raising Cost, Reputation Risk for Companies: S&P

Significant anticipated growth by companies in the use of carbon capture, carbon removal or carbon credits to offset or address their hard to abate or residual emissions will raise challenges and risks over the next several years, according to a new report by credit ratings agency S&P Global Ratings, including uncertainties around cost and effectiveness of the solutions.

While financial and reputational risk from these sources is likely to grow, however, the report found only limited consideration or disclosure by the companies about these potential risks.

The report comes as companies are increasingly setting decarbonization targets and net zero pledges, such as a doubling in each of the past four years of companies of committing to the Science Based Targets initiative, noted by S&P.

While many emissions sources are relatively easily addressable, however, some “hard-to-abate” or residual emissions will be much more challenging to eliminate, requiring companies to rely on alternative solutions or offsetting methodologies to decarbonize, such as carbon capture and storage (CCS), carbon dioxide removal (CDR), and the use of carbon credits.

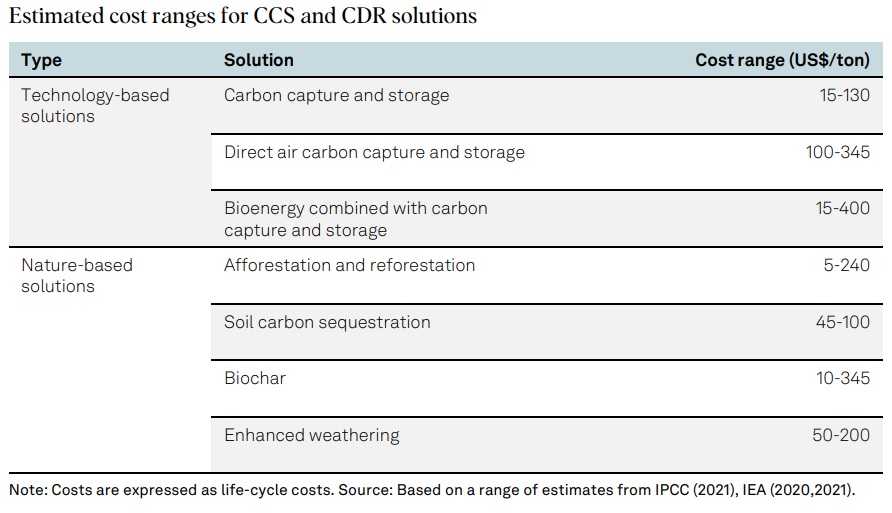

Carbon dioxide removal includes both nature-based solutions, such as reforestation and biochar production, and technological solutions including direct air carbon capture and storage (DACCS). Carbon capture and storage includes a range of technologies to separate CO2 from other gases, often from industrial processes, and transporting for storge or other uses. Carbon credits represent the reduction, avoidance or removal of a ton of carbon through a range of various methods or projects.

The report highlights significant expected and planned growth for each of these types of solutions. For example, six times more CCS projects are planned than are currently operational, according to S&P, and for the report, S&P sampled 25 of the highest-revenue oil and gas companies and found that 92% intend to use CDR.

Each of these solutions, however, carries tradeoffs and risks, including uncertainties about financial costs, regulations and impact, according to the S&P report.

For example, while CCS methodologies tend to have stronger permanence characteristics relative to nature-based CDR solutions, as well as easier carbon reduction monitoring and less vulnerability to accidental carbon release, they are also often at much earlier stages of development and technological readiness, and some CCS projects that have already been developed have not met their full potential due to a variety of technical and economic challenges. Carbon credits often have credibility challenges, including difficult to substantiate benefits, or proving that the projects funded by the credits would not have happened anyway without the credits. Each of the solutions also face potential challenges through causing environmental harm elsewhere, through problems such as increased water demand, low diversity reforestation, among others.

One of the most significant risks highlighted by the report is financial uncertainty, with wide variations noted in the potential life cycle costs of various types of CCS and CDR projects, and difficulty in estimating the costs of hypothetical developments. For example, the report notes estimated cost ranges for DACCS at between $100 – $345 per ton of CO2 removed, and for bioenergy combined with carbon capture and storage of $15 – $400 per ton.

The report also highlighted challenges for investors and stakeholders in assessing the risks facng companies from reliance on CCS, CDR and carbon credits, noting that “few specific regulations govern what requirements companies should or should not meet in order to make decarbonization claims,” with current voluntary reporting guidelines often not aligned.

In its sample of oil and gas companies, for example, S&P found that disclosure of these risks was limited, with less than a third of the companies providing specific disclosures related to risks associated with CCS and CDR including technical readiness or costs, making it “difficult for stakeholders to form a clear view about the deliverability of solutions in decarbonization plans.”

S&P said that over the next decade, it expects “more discussion and disclosure from major emitters across the economy about their decarbonization plans, including how they plan to tackle their hard-to-abate emissions.” The report added:

“Along with other risks in the energy transition, companies that can understand and manage these risks are likely to be better placed to deliver the most efficient and effective solutions.”

Click here to access the report.